Only applicable for Labuan Entity that has no tax outstanding including compound and tax increment. Labuan FSA issues market guidance in order to facilitate applications of the various requirements of the Labuan entities.

Deadline To File Income Tax 2019 Malaysia

The prevailing income tax rate for companies non-SMEs in Malaysia under the ITA is 24.

Tax submission malaysia for labuan. The account has to be audited and file to the local IRB annually. According to Section 41 of LBATA tax shall be charged at a rate of 3 a year on the net audited profits of a Labuan entity carrying on a trading activity. The Malaysia companies will be impacted as these purchases is not entitle to deduction to reduce the tax of the company.

Individuals Individual residents in Labuan with income accruing in or derived from Malaysia are subject to tax. Confusing when is the tax submission deadline in yesr 2021. Taxation for Labuan International Company Tax Rate and Compliance.

Labuan company that dealt with Malaysia residents individual or corporate that have opted to be taxed under the Malaysia onshore Income Tax Act 1967 with a tax rate of 24 on net profit. The rate of tax ranges from 0 to 28 for resident individuals and a flat rate of 28 for non-resident individuals. Lembaga Hasil Dalam Negeri Malaysia.

Please refer to F AQ on Labuan Company Tax for more information. It supersedes the Operational Guidelines No. Among others these include detailed explaination or clarification of rules governing the business and conduct of Labuan entities.

This form can be downloaded and submitted to. The letter states that Labuan entities carrying on other trading activities which were classified under Code 23 for Labuan Business Activity Tax Act 1990 LBATA filing purposes will be required to submit their income tax return forms ITRF under the ITA instead of under the LBATA. A preferential tax rate of 3 will apply to the Labuan entity on its net profits from Labuan business activities if it meets the substantial activity requirements otherwise it will be subject to a tax rate of 24 on its net profits.

Under the amendment to Section 44 of the LBATA income derived from royalty or intellectual property rights is now subject to tax under the Malaysian Income Tax Act 1967 ITA rather than under the LBATA. The key benefit of selecting Labuan as a corporate base is that it benefits from a very favorable tax regime whereby either a company can be taxed on the basis of a tax rate of only 3 which also requires the submission of annual audited accounts or pay a flat rate tax of 20000 Ringgit Approximately 412500 per annum and which. It gives effect to the proposal set out in the LFSAs Circular dated 23 December 2019 in respect of the revision to the ND rates for interest and lease rental payments made to a Labuan Company as defined.

Unit E004 E005. 12020 Procedure on Submission of Amended Return Form dated 6 March 2020. Many foreigners prefer to register Labuan Company to eligible to enjoy 100 foreign ownership and the other attraction is the flexible tax declaration.

The Income Tax Deductions Not Allowed for Payment Made to Labuan Company by Resident Rules 2018 Amendment 2020 Amendment Rules has been gazetted on 24 December 2020. The due dates for the submission of the ITRF under the ITA are. Labuan company will be entitled to 3 tax and Malaysia companies will not be entitled to a 97 deduction.

Resident status of a Labuan entity. Return Of Profits By A Labuan Entity Under Section 5 And Subsection 2B 1A Of The Labuan Business Activity Tax Act 1990. For more info please click here.

LABUAN - Malaysias International Offshore Financial Centre Tax is imposed on an offshore company in or from Labuan that is carrying out offshore business activities as provided for under the Labuan Offshore Business Activity Tax Act 1990 LOBAT effective from the year of assessment 1991. The Inland Revenue Board IRB has issued a letter dated 11 March 2021 to the Association of Labuan Trust Companies ALTC to confirm that Labuan entities would be granted an automatic extension of time until 31 August 2021 to submit their tax returns for YA 2021 based on the financial year ended in 2020. IRBMs Operational Guidelines No.

As long as your Malaysian counterpart willing to accept the non-deductibility as mentioned above Labuan company is entitled to the tax rate according to the latest Labuan Tax. WHY FOR WHOM. Here is the Income tax submission deadline 2021 in Malaysia.

Trust Companies are compulsory to submit 60 of their clients tax return regardless they are carrying on Labuan Trading business activity or Labuan non-trading business activity or dormant companies. Foreign sourced income received in Malaysia by resident individuals are tax-exempt. 12020 Procedure on Submission of Amended Return Form The Inland Revenue Board of Malaysia IRBM has released the Operational Guidelines No.

A Labuan entity can make an irrevocable election to be taxed under the Income Tax Act 1967 in respect of its Labuan business activity. All business owners of Labuan International Company must perform regular compliance for the companies they own to avoid any future complications and penalty. THE LABUAN TAX FRAMEWORK The tax laws relating to Labuan entities are set out in the Labuan Business Activity Tax Act 1990 LBATA.

Deadline To File Income Tax 2019 Malaysia

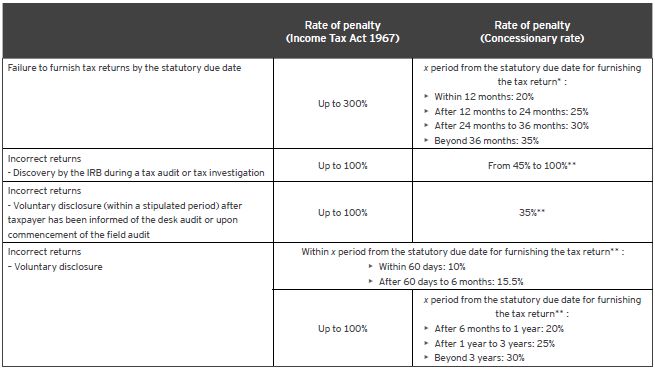

Tax Amnesty Waiver And Remission Of Tax Penalty Tax Malaysia

Deadline For Malaysia Income Tax Submission In 2021 For 2020 Calendar Year L Co

Guide On Personal Tax Filing For Expatriate Employed By Labuan Company

Do Foreigners Need To Pay Tax In Malaysia

Deadline To File Income Tax 2019 Malaysia

Do Foreigners Need To Pay Tax In Malaysia

Deadline To File Income Tax 2019 Malaysia