Total Fertility Rate 18. As of this writing 100 ringgit equals approximately 21 EUR US30 and 18.

Fillable Online Form 7 This Is To Labuan Offshore Company Fax Email Print Pdffiller

In 2015 the population was reported to.

Statistics of labuan company. 11 The purpose of the Reporting Guideline on Statistical Data Submission for Labuan Entities Guideline is to clarify the reporting and submission procedure for statistical returns on the operation of Reporting Entity RE in Labuan International Business and Financial Centre. 1 Integrated Statistical System ISS. In addition it lower taxes more than all of the.

Average Annual Population Growth Rate 08. Trust Companies and Ancillary Services. Area km 2 92.

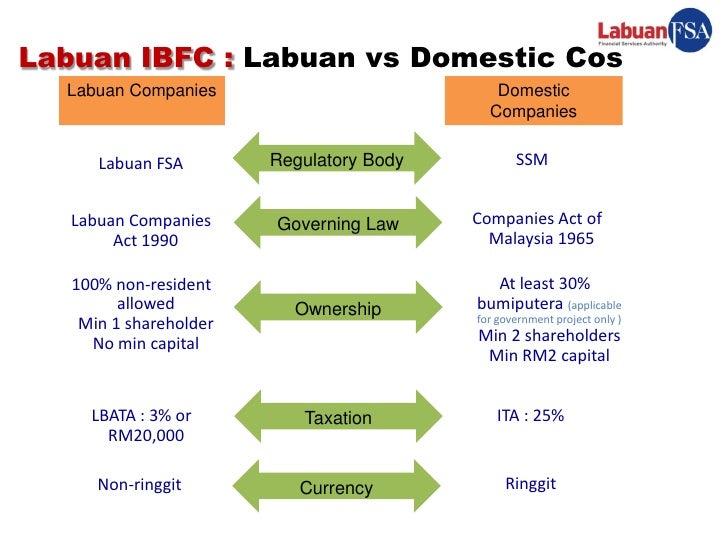

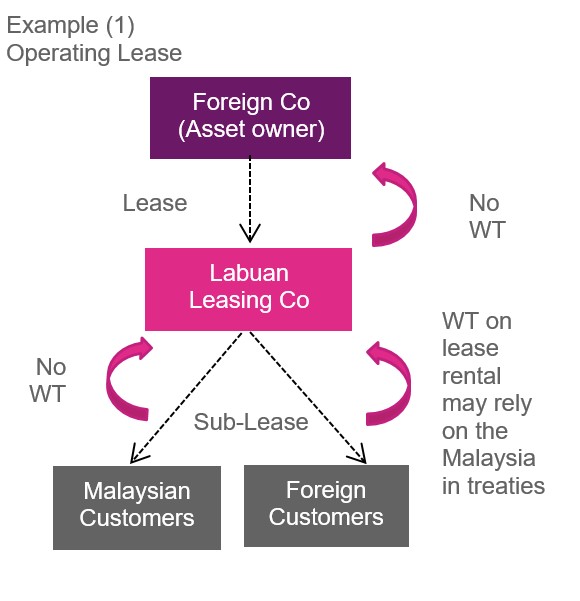

The holding company does not have to pay any withholding tax on dividend payments interests and royalties. Labuan requires corporations keep accounting records. According to Malaysias Department of Statistics Labuan population for 2010 was at 86908 and it is projected to be at 91300 for 2013.

12 This Guideline sets out the following. Federal Territory of Labuan a Glance. It is recommended to start an offshore business in Labuan since Labuan is the main hub for foreign or international business.

Labuan is the place to start any offshore business in Malaysia. Trust Companies and Ancillary Services. Labuan Foundations and Labuan Islamic Foundations.

List companies in Labuan A total of 1000 information In List companies in Labuan you can submit free company information here results page 1 Natural Resources EnterpriseFTN Exporting Main Products. Companies incorporated under this Act and which meet certain conditions including substance requirements would be taxed at preferential rates. Labuan Company Registration Information.

However foreigners prefer the Labuan Company. From a taxation point of view the Labuan international company used as a holding will benefit from a 0 corporate tax rate. The economy in Labuan is developed and stable.

In the light of its status as an international business and. The taxation on the profits of the company registered as a trading company is at a rate of 3 while the paid-up capital is generally 1USD however it can differ depending on the type of company as well as the activities of that company for example it will be larger for a Forex company. Malaysia International Ship Registry.

Infrastructure Labuan has adequate road and port facilities with a shipyard and gas complex as well as sufficient residential and commercial space based on current requirements. Also trading companies that decide to pay the flat tax of 3 must hire an auditor and have their financial statements audited yearly. Department Of Tourism Culture and Arts Labuan Corporation Wisma Perbadanan Labuan 87022 Wilayah Persekutuan Labuan Phone.

Specifically the formal name is the Labuan International Company. Under the Labuan Business Activity Tax Act of 1990 Labuan trading companies pay a tax of 3 which is capped at 20000 Malaysian ringgit per year. However certain issues are to be taken into consideration about the applicable taxation framework in this.

A Labuan company is a company incorporated or registered under the Labuan Companies Act 1990 LCA 1990. For those deciding to pay the tax of RM 20000 are not required to file financial statements. Labuan as a premier IBFC by ensuring the highest level of integrity commitment and professionalism.

Malaysia has several types of companies and corporations. LABUAN OFFSHORE COMPANY IN MALAYSIA. Overall Implementation Plan and Progress ii.

Labuan has a different preferential taxation regime compared to Malaysia. 1 2016 Labour Force Participation Rates. Activities and Implementation Plan with LFSA and Labuan Entities For information 2 Reporting Requirements.

03 2011 Detached Housing Units. Residents and non-residents of Malaysia are allowed to establish Labuan companies. Birth and Death per 1000 population Crude Birth Rate.

The GDP of Labuan is claimed to be successful where its growth rate is 58. Enhanced Statistical Management System. 1 2016 GDP Per Capita at Current Prices - RM.

As already mentioned the SST does not apply to most of the companies and it is not applicable to a category of businesses that are of the highest interest to foreign investors. SugarCrude OilDiesel D2Jet Aviation FuelCementSulphurUreaEthanol Fuel For Cars Tel. Also no management or technical fees apply in the case of Labuan international companies used for holding purposes.

665 2016 Distribution of Labour Force. External Assets. Health clinic Number of health Rural clinics.

The Labuan offshore company. Reporting Requirements for LFSA For information 3 Other Matters For discussion Agenda and Purpose. Most foreigners choose this company type because it provides 100 foreign ownership.

Overview of External Sector Statistics ii.

Publications Resource Centre Labuan Ibfc

Announcements Labuan Fsa Page 2

Announcements Labuan Fsa Page 2

Set Up A Labuan Trading Company Offshore Labuan Qx Trust

Labuan Leasing Business Jtc Kensington

Https Www Labuanibfc Com Clients Labuan Ibfc 78c2ff81 703a 4caa 8926 A348a3c91057 Contentms Img Event Event Presentation A 20guide 20to 20labuan 20asset 20leasing Pdf

Announcements Labuan Fsa Page 2

Https Www Bakermckenzie Com Media Files Insight Publications 2014 07 Legitimacy Of Labuan Structures Illegal Tax Evas Files Read Publication Fileattachment Al Kualalumpur Labuanstructures Jul14 Pdf