Overview of a Labuan Offshore Company Labuan is a small set of islands off the coast of Borneo and ois officially a federal territory of Malaysia. Closure of personal tax file with IRB Personal Tax division 3.

Labuan Company Strike Off Procedure Get The Latest From Cp Trust

205 Hartsdale NY 10530.

Striking off labuan company. Cessation Of Business In Labuan Foreign Company. Very low paid-up capital. Deregistration is A defunct solvent company it is a relatively simple inexpensive and quick procedure for dissolving defunct solvent companies.

As for striking off the Registrar of Companies may strike. Discover the wide range of business and financial services available in Labuan IBFC. Another important characteristic for the Labuan International Company is that it has low requirements for the paid-up capital.

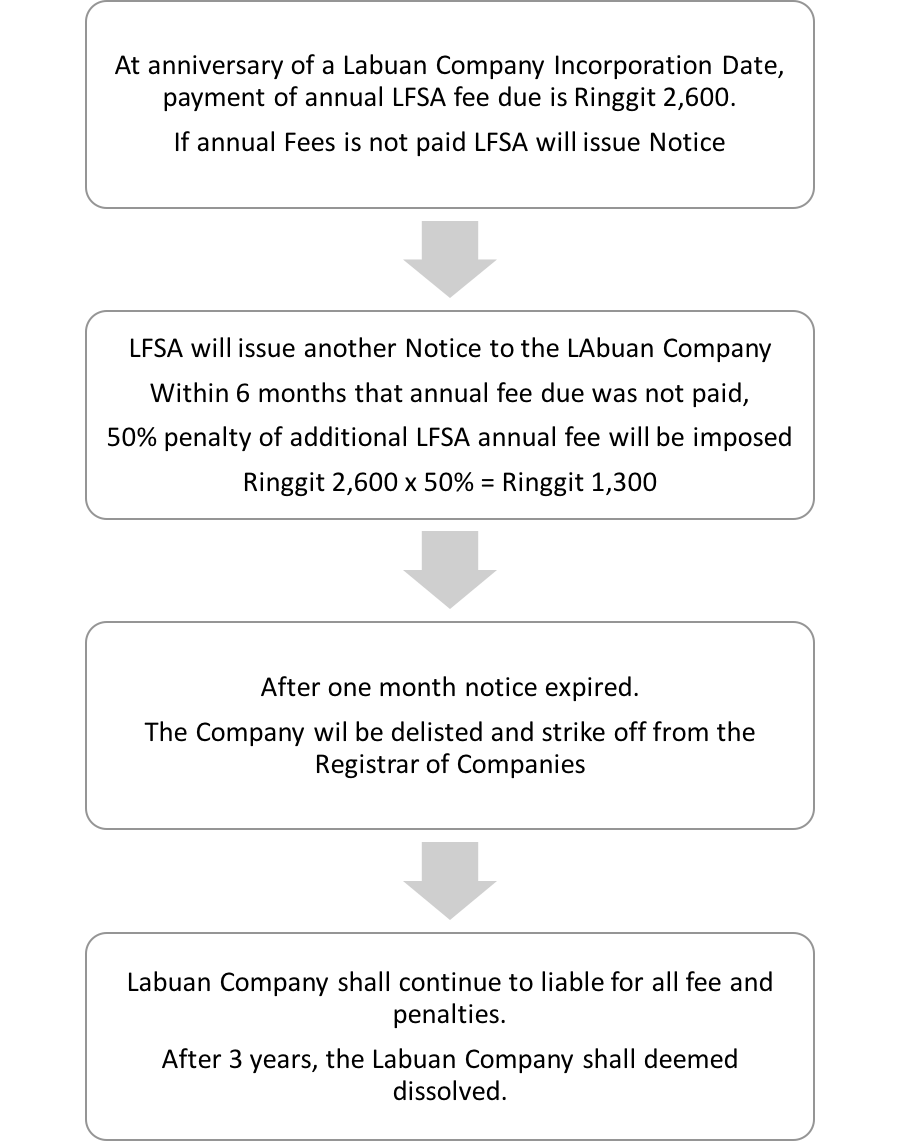

For all Labuan companies intended to strike off or dissolution it is advisable to comply with the following. Effect of striking off. The Labuan company strike off letter electronic copy will be issued by Labuan FSA once the annual fee owed is unpaid after 8 months to 12 months period.

A Labuan company can be struck off for failing to make its payments to the Labuan FSA. The Labuan International Company has these very appealing characteristics one of the main reasons why foreign investors choose to base their operations here. Closure of corporate tax file LE with IRB corporate division Labuan Company and Employer Return E with local.

Labuan officially referred to as the Federal Territory of Labuan is a region of Malaysia where foreign investors are welcomed to register their businesses set up as offshore companies. The amount needed is a minimum of 1 USD a very low requirement and one that. The Labuan Offshore Jurisdiction has become one of the preferred jurisdictions in Asia for offshore company formation since the Malaysian government made it into an international offshore financial centre in 1989.

It generates thru the CORAL system. Non-application of specified written laws. A Labuan company is required to make payment for annual fees to the Labuan FSA within one month before the anniversary date of the Labuan company incorporation.

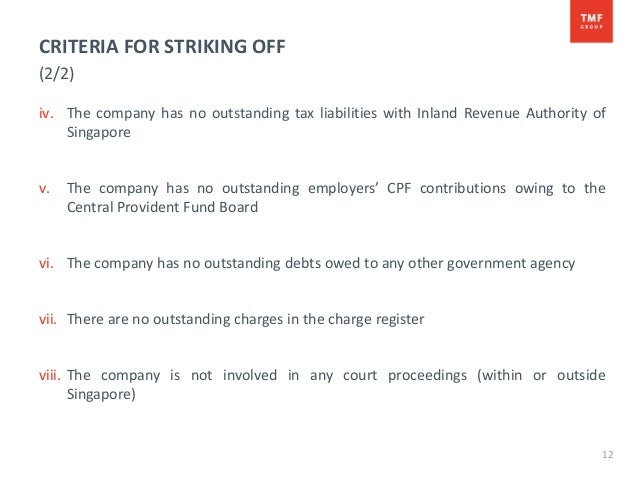

This particular location is one of the most. The company is not involved in any legal proceeding within or outside MalaysiaThe company should not make any application for striking off if it is aware that there is an impending court action against it so as not to deprive others who have initiated court action against the company. Pages 137 This preview shows page 133 - 135 out of 137 pages.

School Tunku Abdul Rahman University. Transfer Of Company From Labuan Notice under Section 133 Labuan Companies Act 1990 from the Labuan Financial Services Authority Labuan FSA G. Dissolution of an LLP Labuan.

Striking off a company voluntarily is cheaper as opposed to winding up or continuing to file annual returns especially if you have no intention of operating the company again. Application of specified written laws. 141 South Central Park Ave.

Dissolution of a Labuan company. Letter of confirmation and letter of good standing. Company struck off liable for fees.

5 notwithstanding that the name of a labuan company. Strike-off requires less documentation compared to a wind up. 5 Notwithstanding that the name of a Labuan company has been struck off the.

An offshore company refers to a business which is incorporated outside the country where the investors reside. Declaration of dissolution of a Labuan company. Fees payable to Authority.

Zerorised all Balance Sheet items include. For all Labuan companies intended to be strike off or dissolution it is advisable to comply the following. Winding up is the process of settling the accounts and liquidating the assets of a company for the purpose of making distribution of the net assets to members and dissolving the company.

Notice under Section 1514 of the Labuan Companies Act 1990 from the Labuan Financial Services Authority LFSA Dissolution through a declaration. Course Title ACCOUNTING 1013. You can opt to strike off your Labuan company anytime after the incorporation.

Striking-off of the name of the Labuan entity. Striking Off Name Of Company Notice under Section 151 Labuan Companies Act 1990 from the Labuan Financial Services Authority Labuan FSA F. A strike off will mean you no longer have to file any income tax returns.

Close all bank accounts Any surplus cash of the Labuan Company is to be distributed to its shareholders subject to the company Memorandum and.

Formation Of A Labuan Company And Tax Information

Guide Cayman Islands Company Voluntary Liquidation Strike Off Pdf Free Download

How To Dissolve A Labuan Company Corporate Services Trust Co Ltd

Labuan Private Fund Registration

How To Terminate Or Dissolve A Labuan Company

Labuan Company Incorporation Services Business Setup In Labuan

Tmf Sg Striking Off For Download Nov2016 Final

Ways To Dissolve A Labuan Company With Professional Help

The New Amendments To The Labuan Companies Act 1990