A Labuan foundation shall be dissolved on the occurrence of any of the following events. However the beneficiaries will need to satisfy their own tax liabilities in their respective jurisdictions of tax residence.

Http Cogentassets Com Foundations

Key Features and Operation Requirement of Labuan Private Foundation.

Tax foundation beneficieries labuan. Beneficiaries under Labuan foundation 6. 2 Where the property of a Labuan foundation include Malaysian property the Income Tax Act 1967 Act 53 shall be applicable to any income derived therefrom. Distributions by a Labuan foundation to its beneficiaries are tax-exempted in Labuan.

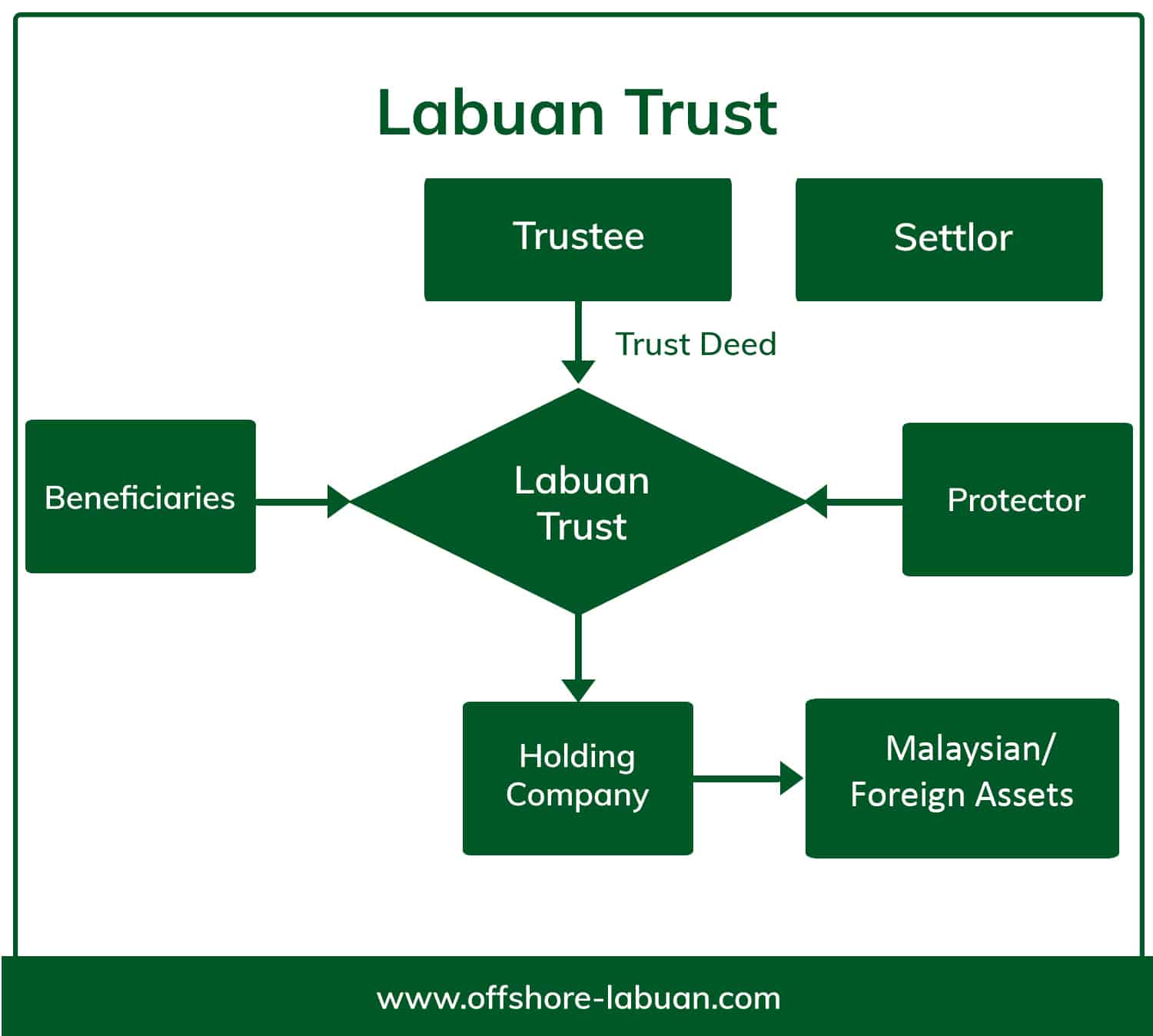

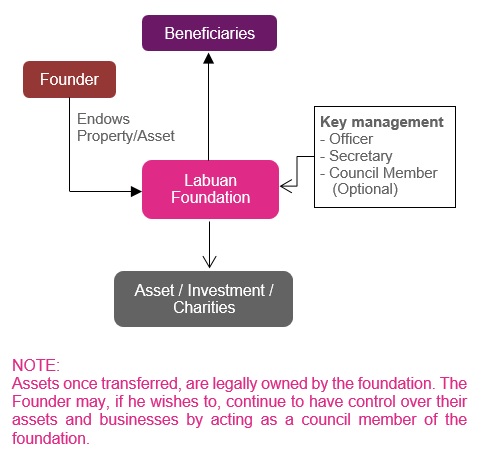

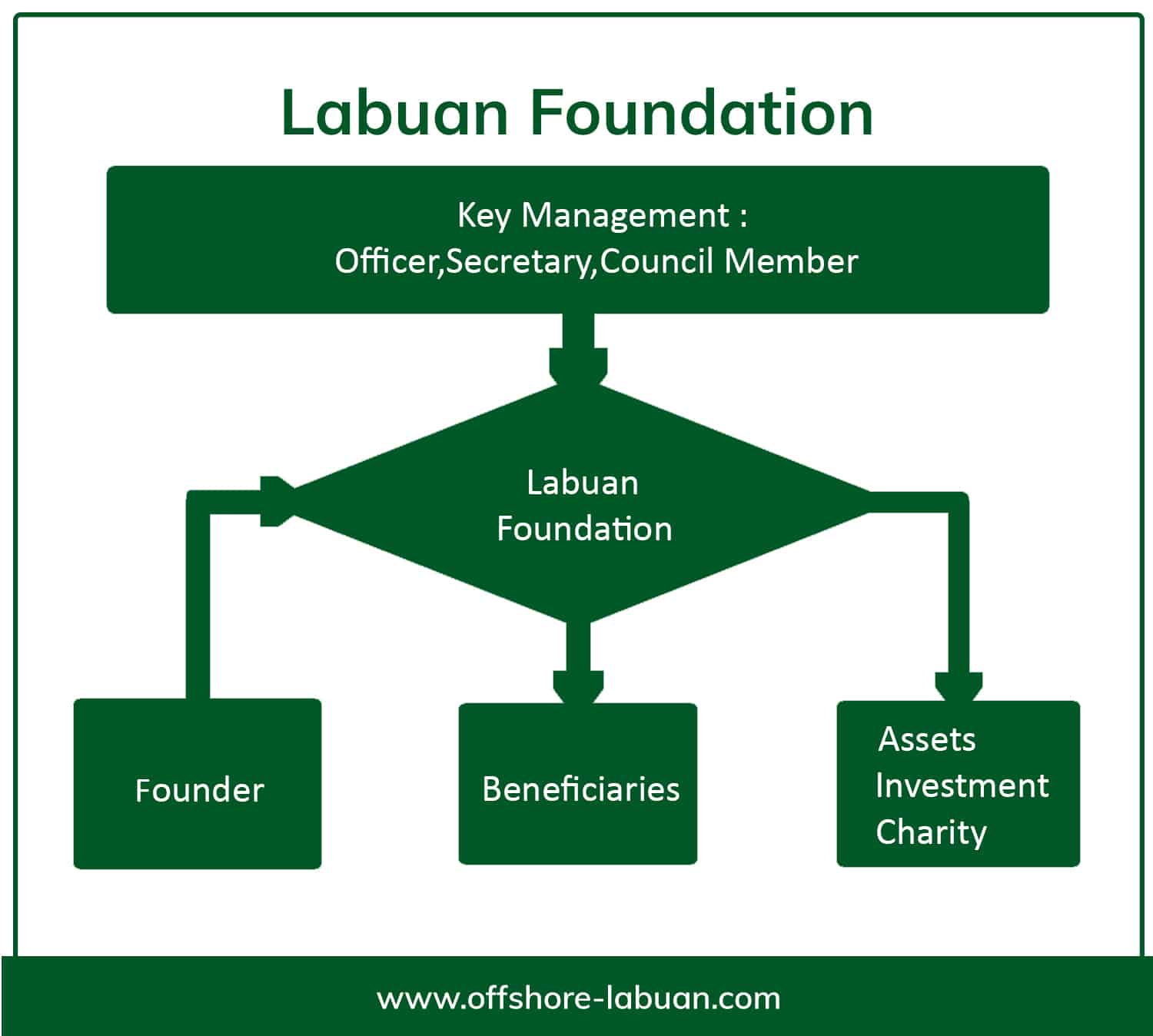

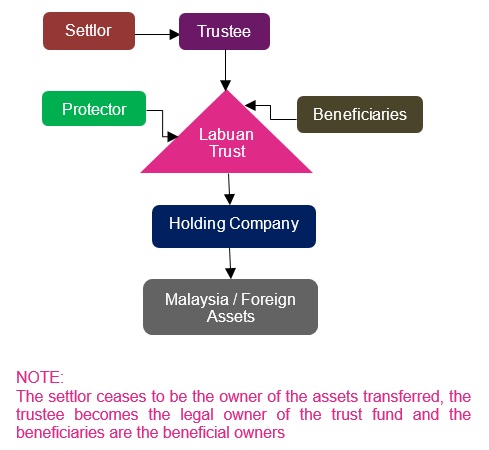

Tax exemption on directors fees received by a non-citizen individual in his capacity as a director of a Labuan entity. Labuan foundation like a company is a corporate body with a separate legal entity established to hold assets in its own names with the objective of managing the assets for the benefit of its beneficiaries or particular purposes or both. Founder can reserve powers and rights over the property endowed in a foundation.

No capital requirements as Labuan Private Foundation can start with only a minimum endowment of USD 100 as an initial asset at the time of the establishment. You may at risk of unable to preserve your assets if your beneficiaries of the WILL dispose your assets. Labuan is a special region of Malaysia which provides an attractive taxation scheme available for foreign investorsBusinessmen can open a company in Malaysia or set up a foundation which is a type of legal entity in which the companys management can start charitable or non-charitable activitiesAt the same time businessmen should know that a Labuan foundation will hold the rights.

Complete Foreign Participation. The maximum tax currently is only 6600 USD. No withholding tax capital gain tax inheritance tax.

Distributions by a Labuan foundation to its beneficiaries are tax-exempted in Labuan. C any provision of the charter of the Labuan foundation so requires. B the purpose of the Labuan foundation is fulfilled or becomes incapable of fulfillment or.

However if you use Labuan Private Foundation there is no tax in any form if the assets remain in the foundation. In that case income derived will be taxed at 3 after net profit. No foreign exchange controls.

Labuan Charitable Foundations function will be typically donating funds and support other non-profit organisations or provide the source of. A clear understanding of the Labuan tax regime is necessary to fully benefit from the available tax benefits. Labuan Foundation can be for charity or non-charitable purpose such as for private family objectives as it provides asset protection for succession planning 6018 388 8189 6087 428 898.

No tax in Labuan on non-trading activities. Labuan Charitable Foundation is a foundation established by the founder for charitable purposes only and is non-profit oriented. The distributions by a Labuan foundation to its beneficiaries are tax exempted in Labuan.

A Labuan foundation is a corporate body with a separate legal entity established to manage its own property for any lawful purpose which may be charitable or non-charitable. A Labuan Foundation enjoys the following benefits. The beneficiaries of the foundation will need to satisfy their.

Tax exemption on 50 of gross income received by a non-citizen individual from exercising an employment with a Labuan entity in a managerial capacity in Labuan or at its marketing or co-located offices approved by Labuan FSA. 0 tax on the distribution of profits to beneficiaries. Labuan Foundations domiciled here enjoy the same generous tax benefits as other Labuan business entities which are taxed under the Labuan Business Activity Tax Act 1990 LBATA but income derived from the holding of Malaysian property will be subject to the Income Tax Act 1967.

However in the Charter andor Articles in Labuan Private Foundation you can clearly spell out your intention in preserving. 1 The beneficiaries of a Labuan foundation may be a resident or a non-resident. Maintain a Registered Office in Labuan which can be the Trust Companys office.

Foreigners can form foundations with complete foreign founders beneficiaries management and assets located around the world. Where assets of Labuan foundation include Malaysian property the Income. A the Labuan foundation is established for a fixed duration and that duration expires.

Key tax profile of a Labuan private foundation. However the beneficiaries will need to satisfy their own tax liabilities in their respective jurisdictions of tax residence. Simple and straight forward tax systems in Labuan.

In the case of a Labuan Islamic foundation its aims and. Once the foundations objectives are met the foundation can be dissolved and any remaining assets can thereafter be distributed to the beneficiaries. Additionally offshore private foundations in Labuan are free from taxation unless they engage in business activities or profitable investments.

Set Up A Labuan Private Foundation Qx Trust Offshore Consultants

Overview Of Labuan Foundation Trust Jtc Kensington

Set Up A Labuan Private Foundation Qx Trust Offshore Consultants

A Guide To Private Foundations For Wealth Management Wealth Management Malaysia

Set Up A Labuan Private Foundation Qx Trust Offshore Consultants

Guide To Register Labuan Private Foundation

Guide To Start Labuan Charitable Foundation Check It Out

Overview Of Labuan Foundation Trust Jtc Kensington