That of the taxation on interest. Tax exemption on 50 of gross income received by a non-citizen individual from exercising an employment with a Labuan entity in a managerial capacity in Labuan or at its marketing or co-located offices approved by Labuan FSA.

Eurasia Trust Ag Bonds Beyond Expectations

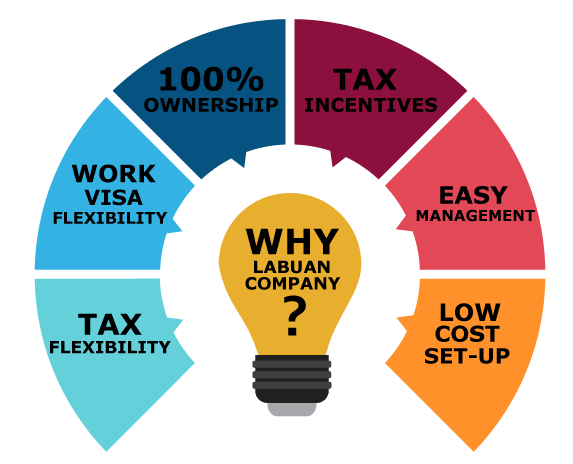

Many foreigners prefer to register Labuan Company to eligible to enjoy 100 foreign ownership and the other attraction is the flexible tax declaration.

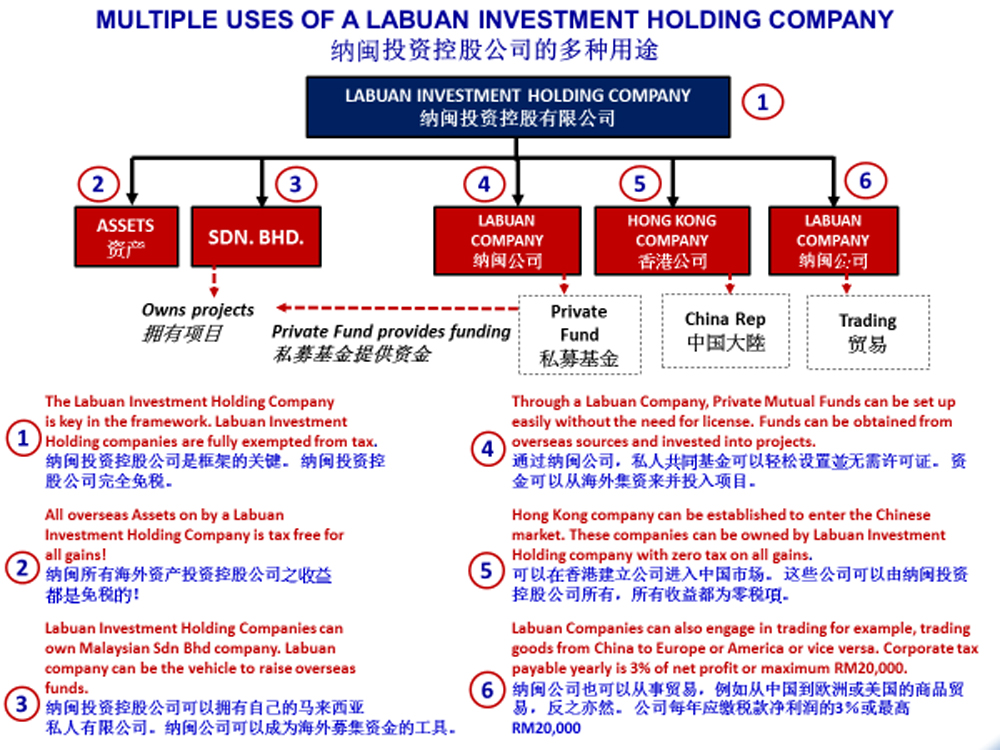

Tax treatment for interest income labuan companie. Pure equity and non-pure equity Labuan holding company. The income tax in Labuan for holding companies used to be 0 with no audit report required but now the holding companies are divided into two categories. 21 Labuan Companies The Labuan Companies Act 1990 LCA provides for the incorporation registration and administration of Labuan and foreign Labuan companies in Labuan.

Same tax treatment as Labuan Trading activity ie. Tax exemption on directors fees received by a non-citizen individual in his capacity as a director of a Labuan entity. 3 of net profits per audited accounts Tax under domestic income tax act 24 Labuan Trading Activity Includes banking insurance trading management shipping operations licensing or any other activity which is not a Labuan.

It is pertinent to bear in mind however that although the interest is treated as income derived in Malaysia it cannot be taxed by way of withholding provisions. Such a holding. Tax Treatment Interest income is chargeable under paragraph 4a or 4c of the ITA.

Malaysia Double Taxation Agreement DTA protects your income from being taxed twice. A double tax treaty offers convenient rates on the withholding taxes on dividends interest and royalties when these payments are made between MalaysiaLabuan and another country with which the treaty is signed. Under the Income Tax Exemption No.

22 Order 2007 2007 Exemption Order due to the terminology used which refers to offshore company instead of Labuan entity Labuan companies and Labuan trusts are amongst the types of entities specified as being exempted from withholding tax on interest royalties and technical fees paid to. Labuan holding company is subject to 0 tax zero tax Labuan licensed company is subject to 3 tax. Labuan Taxes are Easy.

The withholding provisions under s109 apply only when a person pays interest derived in Malaysia to any other person not known to him to be resident in Malaysia. Apply for Labuan work permit dependent pass while working for a Labuan company. Non-Pure Equity Holding Labuan Company hold variety of assets and earn different types of income such as interests rents and royalties the preferential tax rate of 3 on net profits may be enjoyed subject to substance fulfilment of 1 at least one full time employee employment in Labuan and 2 a minimum annual operating expenditure OPEX of RM 20000 is spent in Labuan.

Taxation for Labuan International Company Tax Rate and Compliance. B 25 on Leasing Payment. Under the newly enacted Labuan Business Activity Tax Amendment Act 2020 LBATA 2020 Amendment where Substance Requirements are not complied with effective from year of assessment 2020 the Labuan entity will be taxed at the rate of 24 on its net profits for that year of assessment.

The interest payable by Malaysian companies to Labuan company on loan etc will not be entitled to a deduction to reduce the tax of the company. Income Tax Deductions Not Allowed for Payment Made to Labuan Company by Resident Rules 2018 Dear Valued Client Business Associate Following the gazetting of the Finance Act 2018 with effect from 1 January 2019 the limitation on tax deduction for transactions with a Labuan entity shall be subject to any rules as may be prescribed by the Minister of Finance. Such companies will not come within the provisions of the principal Companies Act 1965 which governs companies operating in Malaysia domestically.

Although Labuan is a federal territory within Malaysia there are preferential tax treatments for companies conducting Labuan business activities such as low fixed tax rate of 3 withholding tax exemption on payments to non-residents tax exemption on fees paid to non-. From the year of assessment 2013 section 4B of the ITA provides that interest income cannot be charged to tax as gain or profit from business under paragraph 4a of the ITA. This is especially important for businesses that conduct activities in both jurisdictions and the principles for the avoidance of double taxation encourage mutual investment between.

Labuan company will be entitled to 3 tax and Malaysia companies will not be entitled to a 25 deduction. All business owners of Labuan International Company must perform regular compliance for the companies they own to avoid any future complications and penalty. Otherwise the corporate tax.

Pure equity holding company receives interest from dividends and pays a 3 corporate tax in Labuan on net profit.

Labuan Company Formation Registration Cost Malaysia

2021 Latest Labuan Tax Info Read The New Substance Requirements

Eurasia Trust Ag Bonds Beyond Expectations

Https Assets Kpmg Content Dam Kpmg My Pdf 2020 07 27 Kpmg My Insights Relooking At Labuan Entities Pdf

Labuan Company For Your Tax Efficiency Check The Tax Saving Rate

Guide On Personal Tax Filing For Expatriate Employed By Labuan Company

Guide On Personal Tax Filing For Expatriate Employed By Labuan Company

Labuan Ibfc Tropical Paradise In The South China Sea Ppt Download