Tax is imposed on the worldwide income earned by Macau-registered entities. July 5 2012 Indian and Pacific Ocean Tax Money Havens Labuan Offshore Corporation Author The Labuan Financial Services Authority FSA has released its 2011 Annual Report which shows continued growth in the key business sectors of the Labuan International Business and Financial Centre IBFC.

Labuan Offshore Opportunities In Malaysia Asean Business News

Registered incomes of more than RM 500000 are levied with the goods and services tax or GST as it is known.

Labuan tax haven australia. Speaking at a press conference on Tuesday prominent member of the Labuan Offshore Financial Services Authority Lofsa Datuk Mohd Azlan Hashim stressed the importance of offshore financial centres in the global financial market and revealed that the authority is working towards correcting the commonly held misconception that all offshore centres are havens for tax evasion and money. In 1946 Labuan joined the North Borneo Crown Colony which in turn became a part of the state of Sabah and Malaysia in 1963. Labuan is likewise a member of the despised family of tax sanctuaries that the Organization for Economic Cooperation and Development OECD is aiming to bridle.

Provide guidance on license application work permit bookkeeping accounting. Best Tax Havens For Aussies Wealth Safe can help you minimise your tax legally by creating an offshore company. Trust Labuan Tax Inc is a Labuan licensed trust company.

Learn more about our tax solutions on our website or contact a Wealth Safe specialist by phone for a no-obligation no-risk assessment of your finances. The jurisdictions many benefits include. Unit B Lot 49 First Floor Block F Lazenda Warehouse 3 Jalan Ranca-Ranca Labuan.

Countries defined as tax havens. Approved by the Labuan FSA from 2013 to carry on corporate services business. Macau is an offshore financial centre a tax haven and a free port with no foreign exchange controls.

Tax haven in Malaysia which has failed to attract big money. Favoured by Robert Maxwell and the most impenetrable haven in. A 3 tax on net audited results.

Malaysia Tax Haven Over the past 10 years approximately Labuan has registered a simple 2500 companies as compared with some Caribbean jurisdictions with more than 100000. Offshore tax havens are seen as the bogeyman by Australian tax authorities and the media because of the way that they are used by the richest among us to reduce their taxable income This podcast demystifies the legal techniques used in offshore corporate structures and explains the terminology of offshore jurisdictions. The following aspects are among the reasons why Labuan tax haven has earned its name and why this destination is chosen for business.

There is no sales tax applicable in Labuan Malaysia. Non-Pure Equity Holding Labuan Company hold variety of assets and earn different types of income such as interests rents and royalties the preferential tax rate of 3 on net profits may be enjoyed subject to substance fulfilment of 1 at least one full time employee employment in Labuan and 2 a minimum annual operating expenditure OPEX of RM 20000 is spent in Labuan. It is also known as an offshore financial centre offering international financial and business services.

In April the Organization for Economic Cooperation Development branded Malaysia-Labuan an uncooperative tax haven. The Labuan Tax framework Labuan is an island in the South China Sea off the coast of the state of Sabah in East Malaysia. The Labuan International Offshore Financial Centre IOFC was created in 1990 as Malaysias first offshore financial hub.

In fact many tax strategists consider offshores the best tax havens for Aussies.

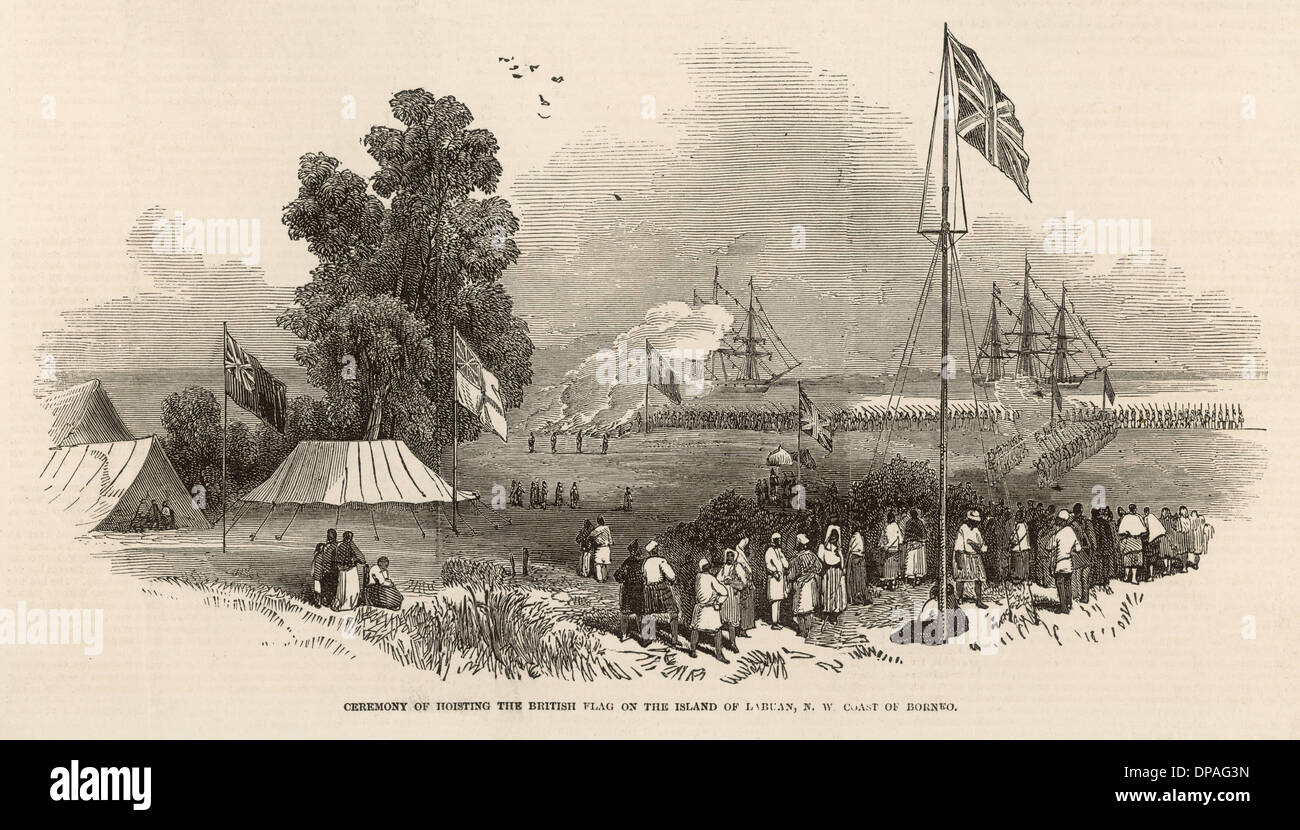

British At Labuan Stock Photo Alamy

World Money Laundering Map Tax Haven Map World

Map Of Malaysia Labuan World Maps

The Labuan Offshore Company Asia S Near Secret Haven Nomad Capitalist

Uncertainty Reigns In Labuan Over Tax Changes

Labuan Malaysia Labuan Malaysia Tax Haven